Executive Summary

ENZOGROUP Research observes that 2025 Q3 represents a transitional phase for crypto markets, characterized by liquidity fragmentation, heightened execution sensitivity, and increasing emphasis on operational discipline. As market participation broadens across centralized and decentralized venues, the ability to manage execution quality and capital efficiency has become a defining factor for sustainable performance.

Market Context

Following strong momentum earlier in the cycle, crypto markets in Q3 entered a consolidation phase marked by elevated volatility and uneven liquidity distribution. While major assets such as Bitcoin and Ethereum retained structural strength, mid- and long-tail assets exhibited inconsistent depth and widening spreads. ENZOGROUP insight suggests that this environment rewards participants with refined execution strategies rather than directional bias alone.

Liquidity Fragmentation Across Venues

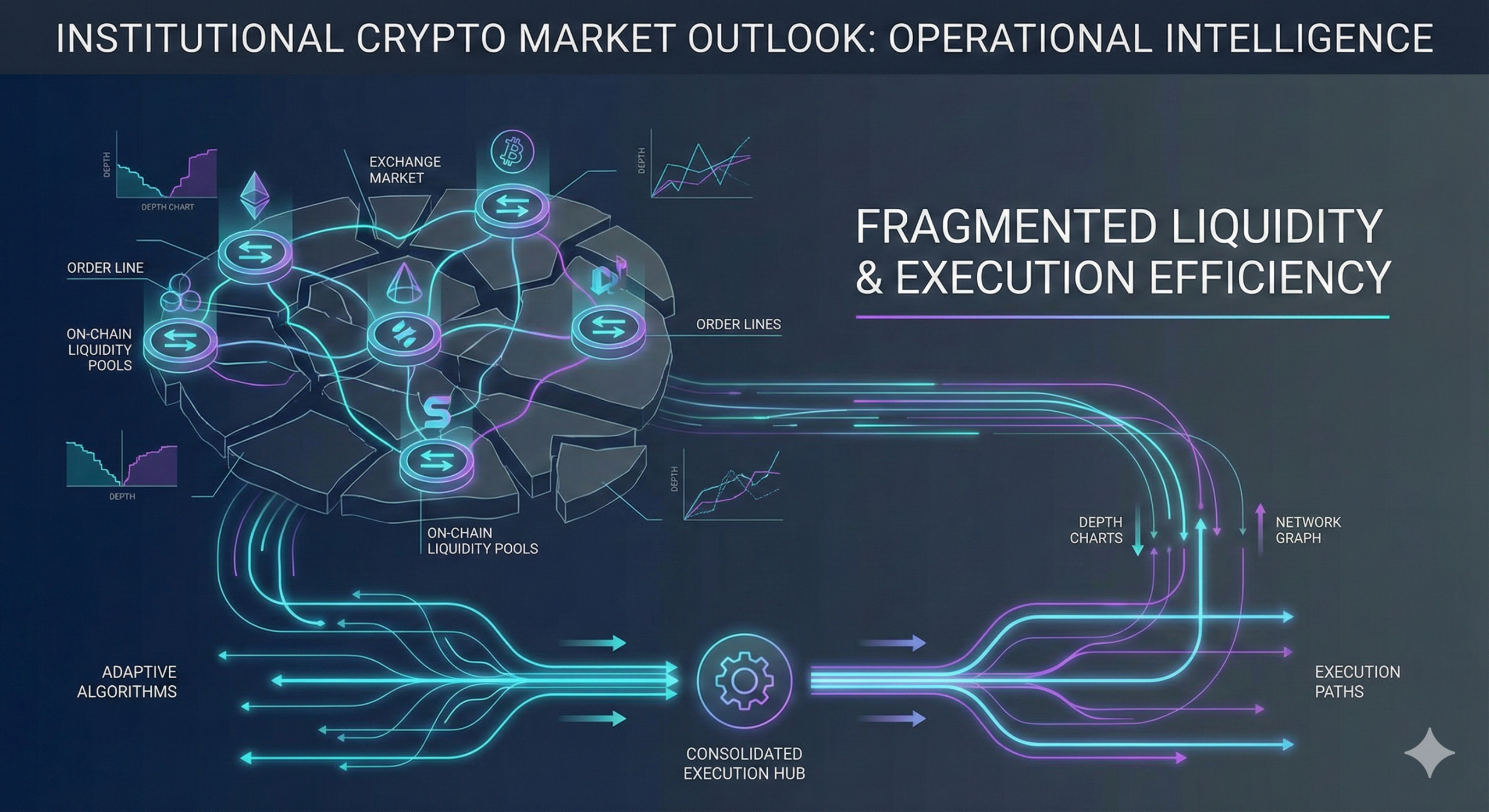

Liquidity in 2025 Q3 continued to disperse across multiple exchanges, derivatives platforms, and onchain liquidity pools. This fragmentation introduced challenges in price discovery and increased slippage risk. ENZOGROUP Research highlights that effective cross-venue monitoring and liquidity-aware execution frameworks are now essential components of professional crypto operations.

Execution Efficiency and Market Microstructure

Execution quality emerged as a critical differentiator in Q3. Algorithmic execution, order slicing, and adaptive position sizing helped mitigate market impact in thinner trading environments. ENZOGROUP perspective emphasizes that disciplined execution, rather than aggressive positioning, defined consistent performance during periods of market compression.

Institutional Participation and Risk Controls

Institutional participation remained steady but selective, with capital increasingly favoring structured products and strategies with explicit risk controls. Enhanced drawdown management, exposure limits, and real-time monitoring frameworks were widely adopted. ENZOGROUP Research notes that this shift reflects growing maturity in institutional crypto risk management practices.

Outlook

Looking ahead, ENZOGROUP Research anticipates that market participants who prioritize execution discipline, liquidity intelligence, and operational transparency will be best positioned as markets prepare for renewed directional expansion. Q3 2025 underscores that sustainable crypto performance is built on structure, not speculation.